High quality liquid assets (HQLA) have gained increased attention from regulators, liquidity managers and collateral managers following the 2008 financial crisis. Banks have been required to more clearly define and manage liquidity with regulations for cashflow mismatch risk (CFMR) and the liquidity coverage ratio (LCR) directly targeting HQLA standards for capital planning reporting. HQLA funds have also become a featured product in the market since they qualify in LCR calculations and can also be loaned and borrowed through securities finance. Additionally, securities finance and collateral management are also both processes influenced by HQLA overall.

High quality liquid assets (HQLA) have gained increased attention from regulators, liquidity managers and collateral managers following the 2008 financial crisis. Banks have been required to more clearly define and manage liquidity with regulations for cashflow mismatch risk (CFMR) and the liquidity coverage ratio (LCR) directly targeting HQLA standards for capital planning reporting. HQLA funds have also become a featured product in the market since they qualify in LCR calculations and can also be loaned and borrowed through securities finance. Additionally, securities finance and collateral management are also both processes influenced by HQLA overall.

HQLAs

HQLAs have gained significant market attention following the financial crisis which resulted in dramatically reported losses and bankruptcies from numerous firms. These assets include a narrow range of investments and securities that qualify as highly liquid including excess reserves, cash, Treasury securities, mortgage-backed securities (MBS) and MBS of U.S. government-sponsored enterprises. To improve their capital positioning, financial institutions have increased their holdings in these assets and concurrently, regulators have implemented new guidelines and laws that include risk measurements involving HQLAs.

Regulations Pertaining to HQLA

Regulations from the Federal Reserve, Basel III and the UK’s Prudential Regulation Authority (PRA) have all focused on HQLA management in capital planning and risk management requirements. Popular forms for the management of HQLAs include CFMR and LCR reporting. These measures use HQLAs as part of the equation for calculating the appropriate capital adequacy of a financial institution.

CFMR is a popular measure used by the UK’s PRA in their Pillar 2 liquidity standards. In its most recent consultation paper on Pillar 2, the PRA outlines a framework for CFMR calculations that focuses on daily liquidity and collateral management needs for banks. LCR measurements are used by the Federal Reserve and Basel III to measure liquidity for a longer timeframe, usually 30 days. Within the financial markets, regulatory agencies have now instituted rules to more efficiently capture all types of risk with both CFMR calculations focused on daily liquidity and LCR calculations focusing on 30-day liquidity levels.

HQLA Funds and Collateral Management

HQLA funds have also become a product of the new market environment. Companies are developing HQLA funds which hold HQLA assets. These funds can be loaned, borrowed or used in the repo market. In November 2016, these funds were first used in an exchange against cash by Société Générale CIB and Société Générale Prime Services through a triparty repo. Now, they have become more broadly integrated into the securities finance market and are being utilized as a source for helping institutions to manage balance sheet liquidity.

HQLA Implications for Securities Finance

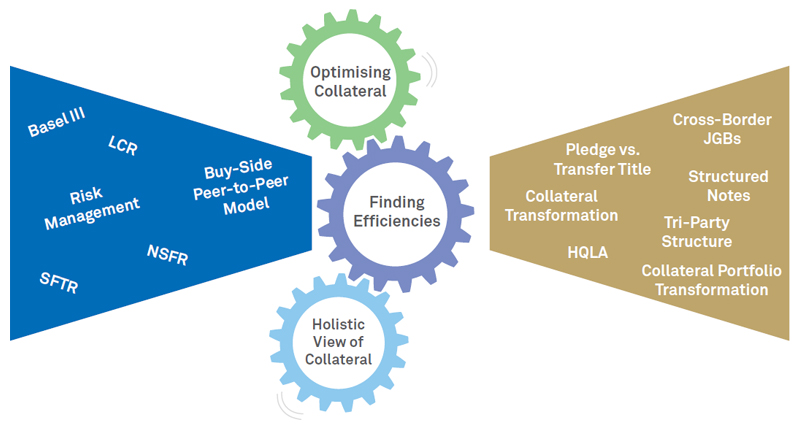

HQLA assets can be important for managing the collateral requirements in securities finance. Securities finance requires a significant investment in collateral management as all transactions are backed by collateral. The current and potential collateral management needs of securities finance transactions are an important part of the equation when calculating HQLA on both a one day and 30-day basis since a portion of HQLA assets are often factored in and allocated for securities finance transactions.

HQLA Regulations Evolving the Market Perspective for Collateral Management

HQLAs have been increasingly gaining more attention, specifically in balance sheet management. Financial institutions are now required to track, report and much more closely manage HQLAs as regulators from all across the world, and specifically the Federal Reserve, Basel III and the UK’s PRA, have been focusing on them more intensely. As the regulations for these assets increase, financial institutions have been forced to reevaluate and also more closely analyze how they manage collateral from these liquidity pools. HQLAs have historically been a source for collateral in securities finance transactions however collateral management teams are now required to assess potentially longer-term types of collateral in order to free HQLAs for the CFMR and LCR requirements that are now being integrated across the market.

Overall, as markets evolve and new regulations become integrated, financial institutions will continue to innovate in new ways to manage regulatory burdens. HQLA funds are one example of this innovation. These funds are now being used more broadly in securities finance transactions, adding an additional option for lending and borrowing against new types of collateral. Collateral management teams will continue to be broadly involved in the management of HQLA and will have the chance to utilize new solutions while also needing to more broadly integrate longer term collateral to support the new HQLA standards.