It is extremely important to build your credit rating very quickly. This article is about how you can quickly raise your credit rating if you’re looking to buy a home for yourself or invest in real estate or maybe buy a car.

It is extremely important to build your credit rating very quickly. This article is about how you can quickly raise your credit rating if you’re looking to buy a home for yourself or invest in real estate or maybe buy a car.

Here are three awesome ways to quickly build your credit rating.

1. You want to get a credit card if you don’t have one and you want to buy absolutely everything on it. We’re even going to emphasize this aspect because this is key to building your credit rating. So when you’re buying food, gas, whatever else you buy – clothes, toys make sure you put it on a credit card because this is going to establish a profile of you if you want a credit track history.

Equifax, which is the Canadian system that oversees our credit rating, can give you a credit, so it’s extremely important to buy absolutely everything by using your credit card. Normally, when you buy something on the credit card you have 28 days to pay off the debt before being penalized and being charged interest. So you never want to get to that point because the interest rate on credit cards is the highest. You definitely want to pay debts off every two weeks maybe even every single week. It is going to build your credit rating very quickly so be very responsible with a credit card.

2 You want to pay your bills before the due date. So same thing with a credit card bill, you want to pay your phone bills, utility bills, car loans, etc. before the due date because you do not want to get a ding on your credit rating every time you have a bill come in and you let it slip, going over the due date. If it happens, you get a ding on your credit rating and the more the things you have, the worse is going to look for you when you try to qualify for a loan or a mortgage for example. Just be responsible with your finances.

The key to this whole article the underlying message: be responsible! Most people in our society are extremely irresponsible when it comes to their finances and that’s why they’re in the position they’re in. So if you’re looking to live a better-than-average life, you have to be better than the average. Be educated and responsible with your money.Credit repair is not really not hard once you get the habit of looking at your bills, at your finances all the time and see what’s coming in and paying them off. It’s extremely easy to build your credit ratings.

3. You do not want to pay off our loans too quickly. With credit card bills and normal incoming bills, you must pay those bills as soon as possible. But when it comes to a large loan – like a car loan – get a big loan or even a line of credit which is just essentially like a credit card with a larger amount and with a much lower interest rate. You don’t want to pay the balance off too quickly. Remember, however, you must pay your payments before the due date so you don’t get charged too much interest.

For specific types of loans such as car loans, school loans, etc. you don’t really want to pay the whole balance off too quickly if you’re trying to raise your credit score. If you already have a good credit score, pay those off immediately as you don’t want to get interest charges. On the contrary, if you’re trying to build your credit rating, you can take a little ding here and record an interest charge because it will pay off in the long run. You want to show a track record; so if you pay the whole loan out completely, you’re not really showing Equifax that you’re responsible. They want to see records that are you paying every single month on time without missing one single payment. Consequently, your chances to qualify for a mortgage or an investment will raise.

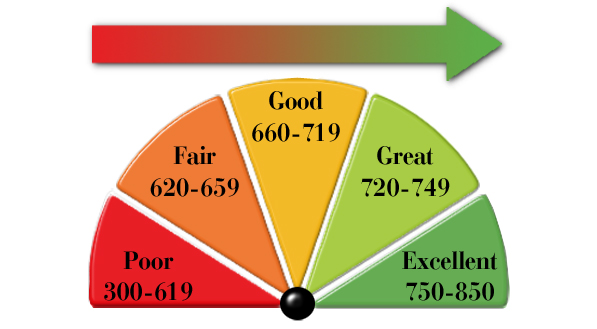

The banks want to see a minimum score of 650. The 650 is average. The banks are constantly changing the mortgage rules and it won’t be long the banks will want to see your credit score up around a 700. However, 750 is really what you want to shoot for but it’s not impossible if you’re really responsible about six months to a year.

If you use these three strategies correctly, your credit rating will soar through the roof very quickly! Good luck!