MSME is known as micro, small and medium enterprises. It is a vital part of India’s legacy economic model. Do you know about 8 percent of India’s gross domestic production (GDP) and about 45 percent of the manufacturing production and 4 percent of exports is contributed by MSME?

Besides, MSME enterprises are significant for the social development of India and generate a large number of employment opportunities. This sector also helps in the development of the rural landscape of the country. So, we can say that MSMEs are the backbone of India.

The Indian government has introduced MSME in agreement with micro, small and medium enterprises act of 2008. These businesses are mainly engaged in the manufacturing, production and processing of goods.

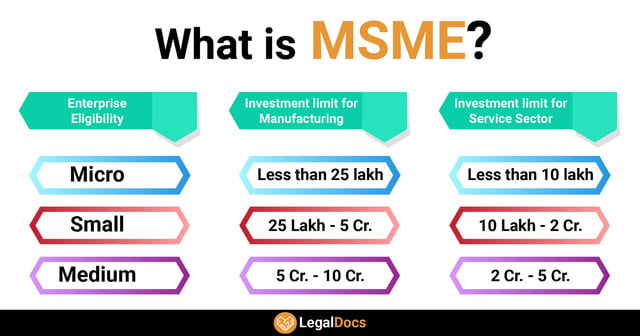

Classification of Enterprises

Let’s take a look at the classification of enterprises into micro, small and medium businesses in the below.

- Manufacturing ( investment towards plant and machinery)

- Micro –> 25 Lacs

- Small –> 25 Lacs to 5 Cr

- Medium –> 5 Cr to 10 Cr

- Services ( investment towards equipment)

- Micro –> 10 Lacs

- Small –> 10 Lacs to 2 Cr

- Medium –> 2 Cr to 5 Cr

Which Businesses Come Under MSME?

According toMSME Registration Act 2006, businesses which can come under MSME act are based on their definition & categorization under either Manufacturing Enterprises or Service Enterprises.

- Manufacturing Enterprises- These business enterprises are engaged in the manufacturing and production of goods as well as defined in terms of investment in Plant and Machinery.

- Service Enterprises: They are engaged in providing services and defined in terms of investment in equipment.

We have mentioned all the Nature of Businesses that come under MSMED ACT, 2006 in the table below, so take a glimpse of them.

| Moulding | Photographic lab |

| Automotive Electronic Component products. | Bicycle parts |

| Stationery Items | STD/ISD booths |

| Auto repair services, and garages | Natural Fragrance &Flavors |

| Retail Trade with low Capital | Printing and other products made of paper |

| X-Ray Clinics | Laundry and Dry Cleaning |

| Engineering and Fabrication | Placement and Management |

| Energy Efficient Pumps. | Active Pharmaceutical Ingredients and Ayurveda Products |

| Beauty Parlor and crèches | Micronutrients For Plants |

| Handicraft | Training and Educational Institute |

| Electronic Surveillance and Security | Retail and wholesale business |

| Equipment Rental & Leasing | Rubber Products |

| Furniture and wood products | Toughened Metallic Ware |

| Consultancy Services | Servicing of Agricultural Farm |

| Khadi Products and Hosiery Products. | IT Solution Provider |

| Mechanical Engineering Excluding Transport Equipment | Auto Parts Components |

| Tailoring | Recorders, VCRs, Radios, Transformer, Motors, Watches |

| Testing Labs for industries | Ceramics and glass products |

| Poultry Farm | Call center |

| Coir Industry | Multi Channels Dish cable TV |

Remember, business entities that do not deal with manufacturing and providing services will not come under MSME Udyam Registration. The key reason behind this is that the prime aim of MSME is to support startups with subsidies.

What are the Key Benefits of MSME Registration?

Some of the key benefits of MSME Registration in India are here:

- The bank loans become very cheap because the interest rate is low (1 percent to 1.5 percent).

- MSMEs get statutory support like the interest on delayed payments act.

- MSMEs get priority on applications of certificates and licenses issued by the Indian government

- Several government tenders which are open for only MSME.

- Many tax rebates which are only offered to micro, small and medium enterprises.

- One time settlement fee for non-paid amounts for MSME enterprises.

- MSMEs get very easy access to credit.

- For registered MSMEs, Minimum Alternate Tax (MAT) can be extended to 15 years. Remember, the regular MAT is 10 years.

Let’s Know About MSME Registration Process

The process for MSME registration in India is very easy. Here are some easy steps.

Step 1- You can register through an online government portal and offline MSME Registration service providers like ExpertBells.

Step 2- Registration for Aadhaar number is compulsory for MSME registration. Also, you can file an application online simply by using the Udyog Aadhaar Registration.

Step 3- The Ministry of micro, small and medium enterprises issues a provisional MSME registration. Remember, the verification can be completed with the e-Aadhaar OTP.

Step 4-Business loans can be easily obtained through this provisional registration.

Step 5- Now you can apply for a permanent MSME license after commencing business.

Step 6- Now a permanent license with lifetime validity can be availed.

What Documents are required for MSME Registration India?

Some of the most important documents required for Online MSME Registration in India are:

- Address proof of the business

- Aadhaar Number & PAN card

- Bank Account Number with IFSC Code

- Copy of the Industrial License

- Memorandum of Association (MoA) & Articles of Association (AoA)

- Certificate of Incorporation

- Receipts and bills for buying of equipment or machinery

- Copy of the resolution that is passed in general meeting of the company.

MSMEs (Micro, Small and Medium Enterprises) are the backbone of our country’s economy. It has proven the amazing growth of India and creating a huge number of job opportunities for unemployment and unskilled people of India.