A health insurance is a necessity for each and every individual and has been made compulsory at work in the case of many companies. The first step for any individual when planning for anything is to ensure that there is enough for health insurance.

The premium that is paid for health insurance can also provide a tax benefit to an individual. This can be done through reducing taxable income and further reducing tax liability.

The premium that is paid for one’s health insurance is deductible under Section 80 of the Income Tax that was in effect from the year 1961. Tax deductions are provided if an individual is paying a premium for medical policy under their own name, their spouse’s name, their parents name (those parents that are dependent on the individual) and in the name of any dependent children.

What Is Tax?

Tax is defined as the compulsory contribution that is given to the state revenue which has been levied by the government on all workers’ income. Tax is also added to the cost of some goods, services and transactions.

Tax presents itself in many forms and needs to be paid by all individuals. Service tax is a type of tax that is levied by restaurants. A tax that is levied on the income of an individual is calculated at the end of each financial year. This tax varies with the income amount per individual. Those individuals who earn more than others such as businessmen or CEO’s of companies are charged with more tax as compared to other individuals who earn less. The tax varies on the yearly income of individuals.

Any person who has an individual health insurance policy for themselves or pays the premium health insurance for their spouse, parents or children is eligible for claiming tax from their health insurance premium. Any member of the Hindu Undivided Family is also eligible for collecting the tax.

Eligibility to Claim Health Insurance Tax

Tax Deduction on Health Insurance Premium

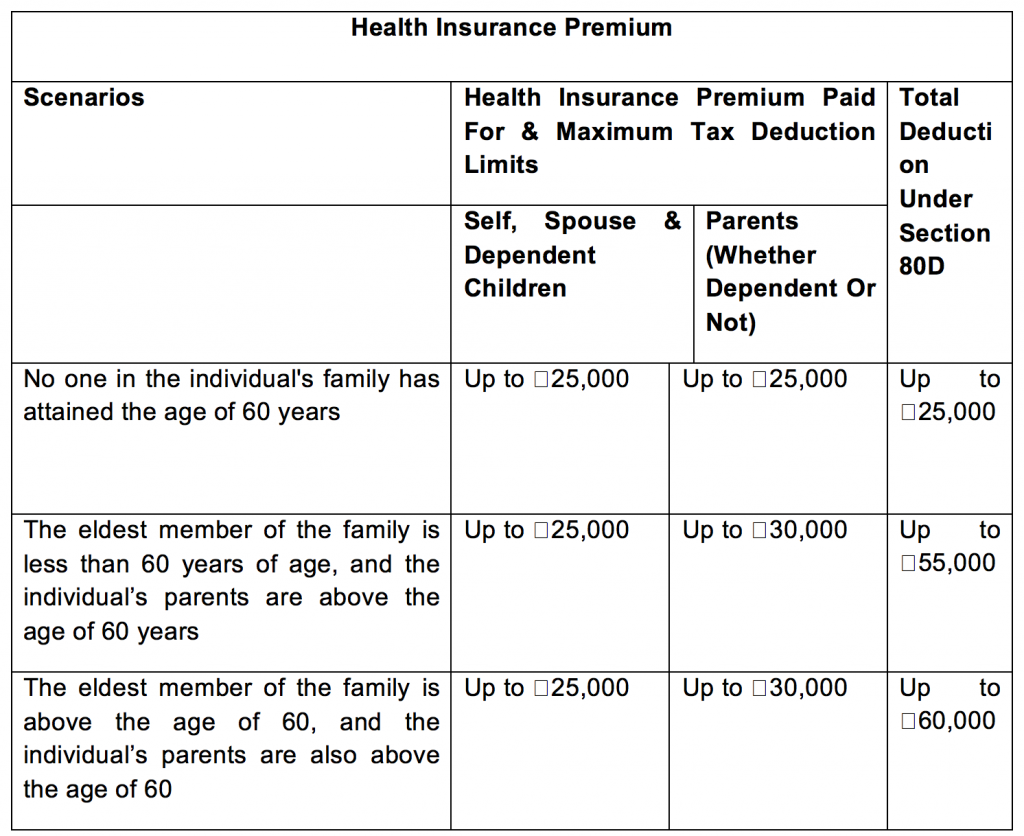

The health insurance premium that is paid for an individual, their spouse or even their children is deductible up to a limit of ₹25,000. The previous limit for this insurance tax was ₹15,000, but with the introduction of the new budget for the year 2015-2016, the limit has been extended to ₹25,000. For senior citizens, the deductible amount is ₹30,000.

Important Points about Health Insurance Policies and Tax Benefits

- An individual can claim their health insurance tax deductions through their employer or through any policy that they have taken. This is applicable for independent individuals as well as those individuals who are employed.

- The amount of premium on the health insurance cannot be paid in cash. It has to either be paid through credit card or net banking).

- Unemployed male children can be covered under the health insurance if they are below the age of 25 years. For females who are unemployed, they can be covered in the health insurance policy until the time they get married.

- An individual who is paying the health insurance premium for their in-laws cannot claim tax deductions. However, the spouse of the individual can pay the premium and get the tax deductions.

- Any premium that is paid on behalf of one’s brother or sister cannot be claimed under tax deductions.

- Only the premium amount on one’s health insurance can be claimed as tax Service tax is also a part of the health insurance plan, but it cannot be claimed as tax by an individual.

How to Claim Tax benefits on Health Insurance

Health Insurance claims can be made while an individual is filing their annual income tax returns document. Those individuals who are eligible policyholders need to fill out the deduction amount that they are entitled to at the end of a financial year.

Documents that are supporting the statement for insurance premium and those that serve as proof are also required for the same. The information that is provided by the individual regarding the amount of tax that needs to be paid has to be as accurate as possible and should match the documents that have been submitted.

What Are Tax Benefits?

Tax benefit applies to any tax law that reduced the tax bill that an individual needs to pay. This tax benefit only applies when an individual fulfills certain eligibility. There are many ways in which tax benefits can come. Some of these are deductions, exclusions, and credit. The type of tax benefit that an individual claim is a key factor to the amount of tax that they can save as they differ from one another.

The tax deduction is the most common type of tax benefit. As an individual is claiming for tax deduction, the amount of tax that is cut from the income of an individual is not deducted. The type of tax deduction that an individual opts for such as health insurance claim or any other insurance affects the amount of tax that is deductible from the paycheck of an individual.

Exclusions that are available for tax are the ultimate tax benefit for any individual. There are no exclusions that can save the paycheck of an individual from paying taxes to the government. However, individuals who stay and work in foreign countries are exempted from paying taxes to the Indian Government.