Investors not only seek opportunities to grow their wealth but also targets the optimization of various tax-saving opportunities. One valuable tool that can assist in simplifying the decision concerning investment and help the investors make informed financial choices is ELSS ( Equity Linked Savings Scheme) calculator. Read thoroughly until the end to know more about an ELSS calculator and why you need it.

What Is An ELSS Calculator?

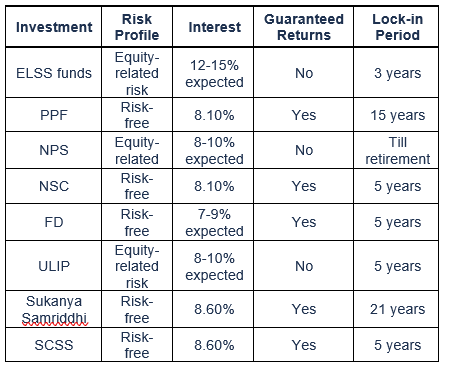

An ELSS calculator serves as a specialized financial tool that is designed to assist investors in evaluating and planning their investments in various ELSS funds. ELSS is a kind of mutual fund that provides tax-saving benefits based on specific tax regulations. This makes it an attractive option for investors who are looking for tax-saving options while seeking potential appreciation of capital through investments in equity.

How Does An ELSS Calculator Function?

An ELSS calculator functions by taking inputs like the amount of investment. Period of investment and expected rate of return. It makes use of these inputs for calculating the potential future value of the ELSS investment. The concept of compounding interest is also applied by the calculator considering the investments in your demat account

However, by factoring in the various tax benefits available under specific tax laws, the ELSS calculator provides an estimation of potential tax savings with which investors can make a comparison of different ELSS funds to estimate the investment’s growth potential. This also assists them in aligning their financial goals with the objectives concerning tax savings.

Why Do You Need An ELSS Calculator?

Using an ELSS calculator can offer significant advantages to investors. Here are some of the key benefits that an investor can secure by using an ELSS calculator:

Appropriate Financial Planning:

ELSS calculators offer precise calculations on the basis of parameters of input like investment amount, expected returns, and total investment tenure. Therefore investors can plan their finances effectively and set investment goals that are realistic and aligns with their financial objective.

Projected Returns:

With historical return data and other relevant factors, an ELSS calculator can provide an estimated range of returns an investor might expect over their investment horizon. This information aids in setting realistic financial goals and managing expectations.

Wealth Accumulation Projection:

By inputting the investment amount, tenure, and expected returns, investors can use the calculator to project the potential corpus they might accumulate. This projection assists in visualizing the growth of their investments over time.

Goal-based Planning:

Investors can use ELSS calculators to link their investments to specific financial goals such as buying a house, funding education, or planning for retirement. The calculator then helps in determining the required investment amount to reach these goals.

Expense Calculation:

ELSS calculators also consider the expense ratio of the fund, which is the annual fee charged by the fund house for managing the investments. This information provides investors with a comprehensive view of potential costs.

Analysis For Tax Saving:

ELSS fund provides tax benefits under the tax laws of the specific country, and these benefits are taken into account by the calculator. This helps the investor to assess the impact of their ELSS investments on the liability of their tax.

Assessment Of Risk:

The calculator also offers effective insights into the risk associated with investments concerning equity. Through a thorough understanding of the return trade-offs and potential risks, investors are able to make a more informed decision and manage their investment portfolio well.

Comparative Analysis:

Another advantage of the ELSS calculator is that it allows investors to draw a comparison between different ELSS funds on the basis of their tax benefits and expected returns. By analysing various funds, investors are able to choose the most suitable one.

Making Informed Investment Decisions

Utilizing an ELSS calculator simplifies the investment decision-making process by offering concrete insights into potential returns, tax benefits, and risks associated with ELSS funds. Here’s how to effectively use an ELSS calculator:

Gather Information

Collect all necessary data, including investment amount, investment tenure, expected returns, and risk tolerance.

Select ELSS Funds

Identify a few ELSS funds that align with your financial goals and risk profile.

Use the Calculator

Input the gathered data into the ELSS calculator to obtain estimates for tax savings, potential returns, and fund comparisons.

Review and Decide

Analyze the results to make an informed decision. Consider the projected returns, risk level, tax benefits, and fund features to choose the most suitable ELSS fund for your needs.

Monitor Regularly

While an ELSS calculator provides valuable insights, it’s essential to periodically review your investment portfolio and make adjustments as needed to stay on track towards your financial goals.

Conclusion

Thus, If you are an investor ELSS calculator is a valuable tool that will empower you to make well-informed investment decisions and ensure accurate financial planning, ultimately helping achieve financial goals.