If you are a business engaged in supplying customers and sending out invoices to be paid at a certain date, then you are undoubtedly aware of how important it is to send out your invoices on time. But making sure your invoices are sent according to a specific schedule is merely the tip of the iceberg, as you also have to make sure that your invoices have all the proper information in order to encourage your customers to settle their accounts without any questions or issues. Invoicing your customers properly is certainly called for. But this process can be tricky if you do not know what to include and how to go about it. Proper invoicing is not just an administrative task - it is a crucial step to ensuring better cashflow for your company as well.

If you are a business engaged in supplying customers and sending out invoices to be paid at a certain date, then you are undoubtedly aware of how important it is to send out your invoices on time. But making sure your invoices are sent according to a specific schedule is merely the tip of the iceberg, as you also have to make sure that your invoices have all the proper information in order to encourage your customers to settle their accounts without any questions or issues. Invoicing your customers properly is certainly called for. But this process can be tricky if you do not know what to include and how to go about it. Proper invoicing is not just an administrative task - it is a crucial step to ensuring better cashflow for your company as well.

How to enhance your invoicing process to avoid late payments or issues

The early bird gets the worm

Have you ever heard of that saying, ‘The early bird gets the worm?' Well, it's true in invoicing as well. This means that the sooner you send out your invoices, the sooner you will get your customers' payments. The way you send your invoices also makes a difference - send them through first-class post or email so you can be sure that your customers receive it way beforehand.

What to include in the invoice

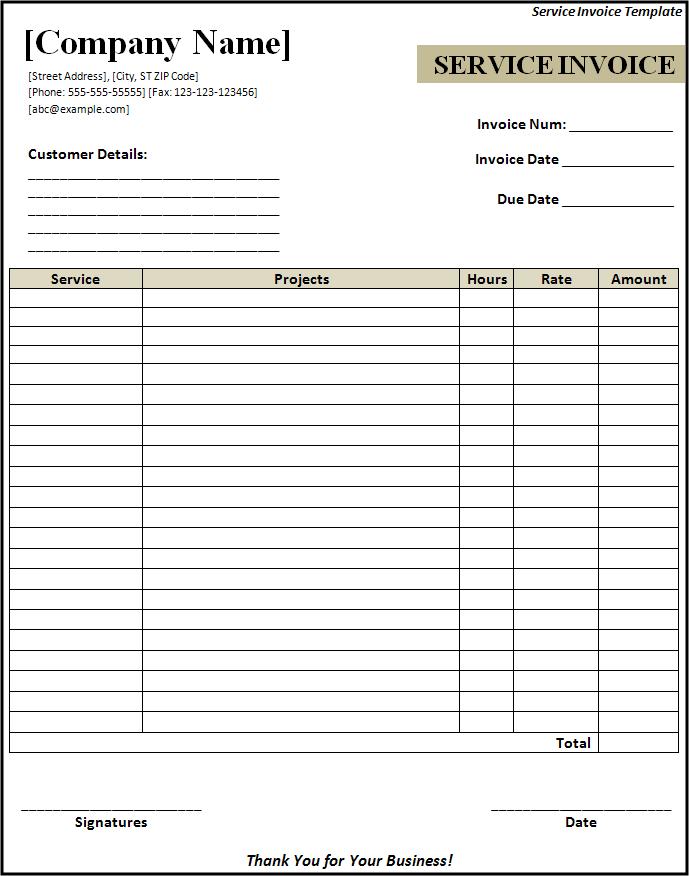

Your invoice should include all pertinent information about the transaction as well as other details. This will eliminate any questions or the need for clarification from your customers, and prevent them from coming up with excuses for not paying because of the (lack of) details in the invoice. Any good invoice should therefore include your company name and your address, your registration number for VAT, the date of the invoice, your customer's name and address, their delivery address if it is not the same as their mailing address, the method of delivery and the date of delivery of the goods or services, the number of the Purchase Order of the customer, a clear and concise description of whatever goods or services you have supplied, and the quantity of these items and their prices as well as the total amount due.

The invoice should also include payment details such as the terms of payment and the date when payment is due, how to pay (including bank account information and other bank details), and an invoice or reference number to be quoted by the customer.

The invoice should also include payment details such as the terms of payment and the date when payment is due, how to pay (including bank account information and other bank details), and an invoice or reference number to be quoted by the customer.

Additional tips for avoiding late payments on your invoices

It would also be a good idea to include a statement in the invoice regarding late payments, especially late charges or fees and interest due on late payments. This way, your customer will be aware of the consequences of late payments. And if, by any chance, a customer pays late or raises any questions about the invoice, always have a set system in place for resolving any disputes or late payments quickly, so you can also avoid cashflow issues resulting from these issues. In any case, making the right invoice and having an established standard for invoicing counts for a lot when you have a business which relies on this payment process. However, if you would like to avoid cashflow problems because of invoicing concerns, you can always turn to cashflow solutions providers such as Ultimate Finance. This type of service not only allows you to receive cash advances based on your invoices - it also provides you with other services such as asset finance, so you can easily expand your business without worrying about your available cash and savings.

Image courtesy of Stuart Miles/ FreeDigitalPhotos.net