Is it still true that gold prices fall when interest rates rise? The popular theory may be based on sound historical foundations, but modern markets regularly disprove the notion.

Is it still true that gold prices fall when interest rates rise? The popular theory may be based on sound historical foundations, but modern markets regularly disprove the notion.

Since the financial crisis of 2008, recovery has been a slow and often punitive process of low wages and diminished disposable income. As governments have become more optimistic in their financial outlook, monetary policy is being tightened, and interest rates that have been extremely low for almost a decade are on the rise.

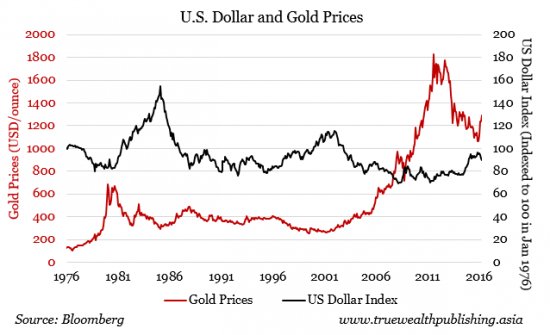

Conventional wisdom says the gold price declines when interest rates rise. The argument goes that as gold doesn’t pay interest, bonds and savings rates would become more attractive as their rate of interest increased. In truth, there is a multitude of factors affecting the gold price, so while an interest rate rise may, in certain circumstances compel the gold price down, it is not an accurate predictor of the value of gold.

There is, however, a more indirect effect of a rate rise. Interest rates have been so low for so long, there is a generation of young property owners who, until recently, had never experienced a rate rise and its impact on their mortgage payments. When interest rates do finally rise to pre-crisis levels of 5%, it could spark a property slump as stretched households default on their rising mortgages. This in turn would affect bank collateral, construction and home builders, and may even hit the equities market.

Josh Saul, CEO of The Pure Gold Company says: “We’ve seen a 78% increase in people investing in gold at The Pure Gold Company in 2018 citing concerns that an interest rate hike will push their outgoings to an unmanageable level. The same purchasers have reported that they are downsizing properties and selling property investments while they can. Many of them plan to invest their property gains in gold, hold onto it, and take advantage of future discounted property prices with any gain they make in the gold.”

What else drives the gold price?

The mere expectation of an interest rate change can affect sentiment in the market and drive the gold price. If policymakers intimate that they could raise or lower rates in advance of any change, investors could buy, or sell, in anticipation, influencing the gold price. If an interest rate rise is already widely expected, the gold price may not change on the day because investors have already sold their gold.

Gold prices are often influenced by economic data that points to improvements or declines in the general health of the economy. Wages, employment, GDP growth, and productivity all affect monetary policy decision-making and so can influence the price of gold. In general, data that points to a weakening economy and the greater likelihood of rate cuts tend to push up the gold price.

The complex effect of interest rate rises was starkly evident in the U.S. in 2015 when the Federal Reserve raised interest rates for the first time in almost a decade. Gold fell as rates rose, but six weeks later weak economic data caused the gold price to rise. Dollar-denominated gold is up almost 25% since then, despite several interest rate rises in the intervening two and a half years.

Inflation is also a well-documented influencer of gold prices. Inflation is the increase in money supply, something that has been profligately practiced since 2008 using ‘quantitative easing’ policies. As the money supply expands, more people demand the same goods so prices rise. But when there is more money in circulation, it devalues the currency, so it takes more of the devalued currency to buy the same amount of gold, pushing up the price.

For this reason, gold is often cited as an inflation hedge, because it maintains its value even when inflation devalues the currency. Like interest rates though, in practice, this link is not indelible. There are circumstances where other factors influence gold more than inflation, from market sentiment to geopolitical issues, to price speculation.

Currency movements, like inflation, usually push the value of gold in the opposite direction. When sterling plunged after the Brexit vote, gold jumped a commensurate amount in sterling terms.

Ultimately the value of gold is dependent on supply and demand. When the gold price rises, holders of gold have an incentive to sell, so even grandma’s heirloom bracelet may be for the smelter. Low supply and high demand were behind the strong rise in the gold price in 2016, and a large proportion of demand was spurred by uncertainty.

The shock Brexit vote in June 2016 and then the surprise victory of Donald Trump in November created a very uncertain market at the time, and this volatility sent investors rushing for a safe-haven asset. More recently, the predictions of international conflict, most significantly between the USA, Russia, North Korea, and Iran, are very destabilising for international geopolitics. This has spooked markets and prompted investors to remove exposure to stocks and other potentially volatile assets. They are buying physical gold to protect their assets while eliminating institutional risk at the same time.

The Bank of England decided in May not to raise rates. The decision was not a surprise to market watchers who had noted the poor growth rate data for the first quarter of the year. But a further rate rise is expected soon, and investors need to take that into account, along with the other factors that influence the gold price.