Freelancing is a choice of those who believe in the virtue of being self-made and achievements.

Freelancing is a choice of those who believe in the virtue of being self-made and achievements.

Earning money is a classic choice of those who believe they can make their living better. It makes one independent, and when the very thought is cultivated in the mind of people, they start taking jobs. Those who did not believe in banal work culture picked up freelancing.

“Your life doesn’t get better by chance; it gets better by change.”-Jim Rohn.

Sitting idle doesn’t help, but freelancing does. Yes, freelancing is for you if you are looking to cultivate your passion more significantly than it is and earn money out of it. Though freelancers face the music of freedom to work, they do bear the brunt of varying income levels. In addition, working with international clients brings the hassles of receiving payments. This is why many payment processors stepped in, enabling freelancers like you to bake your success stories.

Let us look into the role play of global payment solutionsproviders.

Table of Contents

- Freelancers and their dependence on global payment solutions

- Different global payment solutions.

- Global Payment Solution- The baker of freelancing success stories.

- Conclusion

Freelancers and their dependence on global payment solutions

Technology has led to better connectivity for the freelancers pushing the gig economy. Gig workers can remove the geographical barriers and work with clients from abroad. This looped in the global payment solutions.

As a freelancer, you can deeply connect with how it feels to live from paycheck to paycheck. You understand the challenge of waiting to receive international payments after submitting your work. It involves you following up on the payments regularly and tallying whether the amount is credited to your account or not.This is one part of the story.

Another aspect is that working with international clients gives an exposure of another level to the freelancers. They have professional work ethics and clear work definitions. Some freelancers believe, unlike the international clients, domestic clients at times lack professionalism.

In the past decade, freelancers have shown interest and comfort in working with international clients. However, they were liable to receive payment higher than what the domestic clients would pay them. Thus, though India offers affordable freelancers to the world, it ropes in increased dependence on global payment solutions.

Different global payment solutions.

India is a country with a massive population of 139.54 crores. In common, what masses follow becomes a trend. That is how freelancing came into being.

Poppy once said, “Goth is dead, punk is dead, and rock ‘n’ roll is dead. Trends are dead. Nothing exists anymore because the world is spinning faster than any trend.”

We have been a part of a society where working in full-time jobs was the only honorable thing. Freelancing was never accepted up until last year when the pandemic crashed the financial status of the families. From then on increased the relevance of the global payment solutions also.

Here are some of the widely accepted payment processors.

Payoneer

Payoneer has made it simple and easy for freelancers to accept cross-border payments. It provides a user-friendly platform where individuals can easily view their transactions by selecting transaction types. Users can send the invoice to their customers anywhere in the world. Payoneer is one of the best payment solutions for freelancers.

The transaction processing speed is faster, after which you can access your funds within 2 to 6 hours. Payoneer charges an annual fee of $25 in the name of account maintenance.

PingPong

PingPong is another global payment platform that complies with the regulations. It helps freelancers save a lot of money with the low-cost transaction fee of 1% all-inclusive. You can send or receive money using PingPong from any part of the world. Freelancers can receive money to their Indian bank account within 1-2 days, faster than other service providers. Furthermore, using PingPong is more manageable as it includes only a three-step process. First, a freelancer can make their account on PingPong and select the currency to receive the payment.

PingPong offers automated FIRC, which saves a lot of time and money with its low transaction fees.

Transferwise

Transferwise is a safe international payment service provider that helps freelancers to receive money in local currency. Users can save money with Transferwise as they use the exact currency conversion as Google.

Apart from currency conversion, the transaction fees will depend on the sender as well as the receiver.

PayPal

PayPal is an age-old payment platform for freelancers to receive international payments. The best part with the service provider is that it supports operations in multiple languages. In addition, PayPal is reliable because it is one of the oldest payment solution providers.

The only hitch freelancers feel using PayPal is the high transaction fee of 10% that the company charges. You can also send the payment links to the clients using which they can make the payment.

Stripe

Stripe is also a trusted freelance payment service provider to receive remunerations from international clients. The service is applicable in more than 130 countries.

The company charges you 2.9% +.30 cents for every transaction. There is no monthly or annual fee imposed by the company.

Instamojo

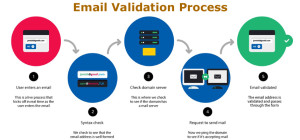

Instamojo is a global payment service provider that processes transactions using email addresses or user names. For every payment transfer, the user will have to pay a fixed cost, but there are no monthly fees.

Razorpay

Razorpay is a fast payment processor that allows users to create quick payment links. You can send these links via mail, messenger or SMS. Freelancers can easily track the payments on one go. They can also set auto-reminders to the late-paying clients. Razorpay is a versatile platform to accept payments from your clients. With Razorpay, you can provide your customers with the facility to make part payments.

You may also like: 7 Tips to Set You up for a Massive Freelancing Success

Table of fee charged by different payment processors in India.

| Global Payment Solution | Fees |

| Payoneer | $25 as annual fees. 3% if you receive the amount directly by your clients via credit card and 1% for ACH bank debit US only. To receive money in receiving accounts, there is no fee for EUR, USD, GBP and others. But to receive the money in USD, the fee Payoneer will charge is 0-1%. |

| PingPong | 1% per transaction all inclusive |

| Transferwise | Different for different countries. |

| PayPal | 3.4-4.4% |

| Stripe | 2.9% +0.30 cents |

| Instamojo | 5% per 1000 +3 GST 18% on this fee. |

| Razorpay | 3% and 18% GST applicable on this fee. |

You may also like: What’s The Difference Between ACH and Wire Transfers?

Global Payment Solutions: The baker of freelancing success stories.

Transfer of money across the border as a part of remunerations has always been a concern for freelancers. A standard payment process involves transaction fees as well as currency conversion charges. Some payment solution processors also levy the annual maintenance fee on the freelancers. These are a few things you cannot do away with and expanding the work as a freelancer would not be possible.

Freelancers who use Payoneer enjoy using it as it can be deployed all over the world. For example, people in India using Payoneer believe that it is a trustworthy payment system. Another freelancer writer Eliana Barrionuevo expresses that Payoneer gives the freedom to use it all over the world.

Similarly, individuals who freelance mentioned that PingPong helps them save money as the transaction fee is 50% less than the competitors.

The concept of payments and the cost of transaction fees is evident. How freelancers become successful can now be understood easily.

With global payment solutions the freelancers can earn benefits like these:

- Secured payment solution to receive money directly into the Indian bank account.

- No hassle to receive money from international clients.

- Cost-effective payment solutions assure you of payment from international clients.

- Gain confidence to work with global clients.

- Gradually freelancers can establish themselves as a brand.

Conclusion:

Freelancing otherwise comes with challenges like managing your transactions, procuring new clients, negotiating the rates with the clients, and following up on the payments. If the burden to follow-up and receive the payments can be resolved with the payments processors, the rest can be managed by freelancers.

The global payment solutions assist in baking and shaping the careers of freelancers successfully. These platforms allow them to manage and follow up their transactions along with monitoring the fee charged. They can keep a monthly record of all the outgoing and incoming payments. In any profession, if the money is sorted, you can concentrate on quality more. This has changed the game for freelancers.