It’s a safe bet your credit card statement doesn’t even register in the pantheon of your great reads. But when it comes to maintaining your financial health, it’s a document with which you should be well acquainted.

In addition to keeping a running tally of your monthly expenditures, the information it contains could mean the difference between enjoying interest-free purchases and paying finance charges on them for what could feel like the rest of your life.

With that said, deciphering credit card statements is simply a matter of considering each of the sections and understanding the key information presented therein.

Here’s what you need to know.

Account Activity Summary

This is where the totals of all of your purchases, payments, credits, transfers, advances, fees, interest charges and past due amounts for the billing period will appear. This section is where you will also find your new balance due, as well as your available credit (your credit limit minus what you currently owe). The last day of the billing period the statement reflects is disclosed there as well. Any payments or charges made after that date will appear on the following statement.

Payment Information

Your current balance, the amount of your minimum payment, and your payment due date will be found in this section. Payments are generally considered to be on time when they arrive at the issuer’s payment center before 5:00 p.m. on the due date. If the due date (which is usually the same date each month), falls on a weekend or a holiday, you’ll have until 5:00 p.m. on the next business day. Depending upon the format, this section will also disclose the fees and interest bump you’ll experience if your payment is late.

Minimum Payment Disclosures

Here, you’ll find a breakdown of how long it will take to pay the balance off in full of minimum payments. It should also tell you the total amount of your payments if you choose to pay on that schedule. This of course, assumes you make no additional charges.

Interest Rate Changes

If you went over your credit limit, or paid your bill late, this section will tell you what your new interest rate will be adjusted to become. By law, credit card companies have to inform you of this 45 day before the changes take effect. So, while it will be disclosed on this current bill, it won’t kick in for another month and a half. This is also true for any other changes in the terms of your cardholder agreement.

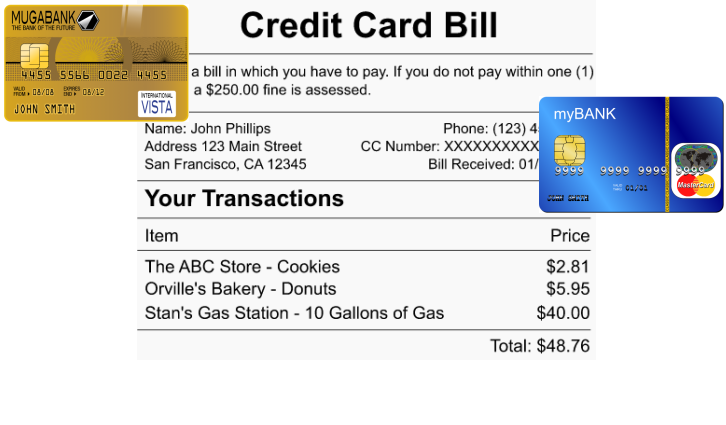

Transaction Summary

This section contains a list of all of the new charges, payments, credits, cash advances and balance transfers you made during the billing period. While each area of the statement is important, this is where you are most likely to find erroneous charges, or evidence of fraud perpetrated against your account. Scrutinize this section carefully to ensure everything it reflects happened with your knowledge and approval.

Fees and Interest

Card issuers are required to break these charges out separately, to prevent unscrupulous issuers from burying them. Interest charges must be delineated by the type of transaction to which they are applied. Remember balance transfers, cash advances and checks supplied by the issuer are usually charged at a higher rate of interest—and can entail separate fees.

Year-to-Date Summary

This section tells you where you stand in the calendar year in terms of fees and interest charges assessed against your account. Carefully managing your charges and paying on time will keep these totals as low as possible.

Deciphering your credit card billing statements in this manner can help you keep your finances well in hand. If things have already progressed to the point at which they’re threatening to become unmanageable, you might consider the services of a debt relief firm.

The really good ones will analyze your credit card statements and help you with a plan for reducing your obligations to make paying them off in full more viable. However, before you select one, take some time to review information such as these Freedom Debt Relief reviews to make sure you’re contracting with a reputable firm.

In the end, maintaining (or repairing) your financial health depends on examining your credit card statement and taking active steps to secure your future.