Buying your first home is an exciting and rewarding experience; a real milestone for all of us. But have you actually given proper thought to whether you can really afford it – and are you prepared for the mortgage application process?

So, you’ve been house hunting, trawled through hundreds of properties online and toured too many to count. Finally, you find a house that looks perfect. It’s in a great location, has good links to major cities and is close to family and friends. There’s only one issue, the price.

House prices in the UK are increasing dramatically as the market becomes more confident, so ensure the price is in the budget before you get your hopes up about a property.

The first thing to think about is your deposit. Lenders will often require a 5% deposit on any mortgage, so for example if the total cost of the property is £150,000 you will have to find £7,500 for the deposit.

The larger percentage deposit you leave, the cheaper the mortgage repayments will be. This can be essential to those households which haven’t got a lot of money month on month for outgoing costs.

The larger percentage deposit you leave, the cheaper the mortgage repayments will be. This can be essential to those households which haven’t got a lot of money month on month for outgoing costs.

Once you’re confident that you have enough saved for the deposit on your dream home, it’s time to start looking at mortgage deals.

There are many different mortgage deals to choose from, so picking the right one for you can be tricky. Which option is best depends on, for example, whether you want the security of a fixed monthly repayment or are happy to opt for a variable rate, which may be cheaper initially but will get more expensive if interest rates rise. Those preparing to apply for a mortgage will now have to adhere to new stricter guidelines which have come about after a comprehensive review of the mortgage market.

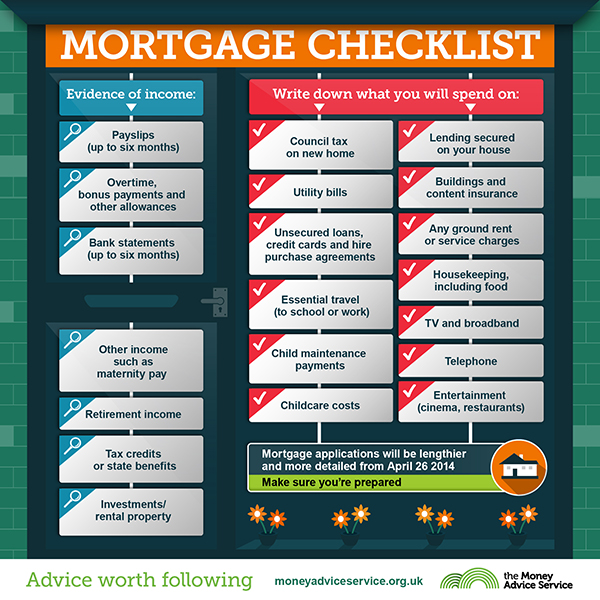

These major changes to UK mortgage lending rules came into play on Saturday (April 26). These new rules mean that anyone wanting to apply for a mortgage will have their financial situation and personal details closely examined by lenders to ensure they can afford the repayments not only now but also in the future.

Martin Wheatley, chief executive of the financial conduct authority, told the BBC that these new rules will enable lenders to make better decisions about who they lend to.

“In the past too many people got a mortgage by simply telling their lender they would have no problem repaying their debt, and that was that, our new rules will hardwire common sense into mortgage lending.”

Unfortunately, for first-time buyers, this means putting in a lot of extra work into your mortgage application and ensuring your personal finances are in excellent order. It’s not just a case of gaining the mortgage you want any more – consideration has to be given to being able to meet the monthly repayments required.

The Money Advice Service (MAS) has put together a checklist designed to help people be prepared and gather up any documents or information they may be asked to provide to a lender. You can have a look it yourself by checking out the graphic below.

If you’re struggling to work out if a mortgage is affordable for you, and that you can also cover the costs of running a home, MAS has also created a mortgage calculator, which you can try for yourself by clicking here.

The MAS website has a host of information on how to manage your finances and make the best impression to the lenders.