The concept of consumer borrowing has been a hot topic since the Great Recession, particularly as irresponsible lending was considered to be one of the prime triggers of the sub-prime mortgage collapse in the US. We have seen the levels of consumer confidence and borrowing rise gradually as the global economy has recovered, however, with the rate of lending in North America having risen by an impressive 8.5% during 2016.

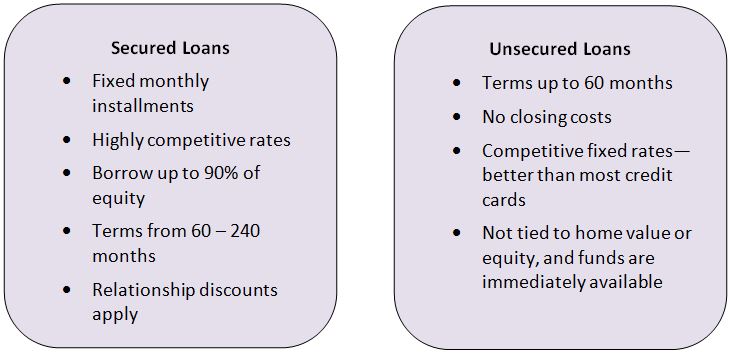

Aside from a slight decline in borrowing in the wake of the EU referendum, we have seen a similar trend in the UK, with households increasingly willing to spend and invest in secured assets such as homes and auto-mobiles. In fact, it is secured loans that are primarily responsible for the spike in borrowing, thanks in part to improved consumer sentiment and the increased drive to regulate short-term and unsecured lending in the Western world.

Secured vs. Unsecured Lending: The Key Considerations

When it comes to borrowing, however, your choice between a secured or an unsecured loan will depend largely on your circumstances. This is especially true in the modern market, where there are a significant number of loan variations and options available to customers. With this in mind, let’s take a look at some of the key considerations that will influence your final decision: –

What is the Purpose of your Loan?

This is perhaps the most important consideration, as it dictates the amount that you need to borrow and the way in which you intend to use these funds. These factors, in turn, will impact on your ability to repay the loan over time, helping you to fully appraise the terms and conditions associated with each potential agreement.

If you have a sudden and unexpected expense which impacts on your daily existence (such as the need to repair a damaged car), you can easily fulfil this with a short-term loan. This provides a quick and seamless solution, without requiring you to offer collateral to secure the loan.

Of course, the requirement for more substantial funding will turn your attention to secured loans, and lenders often look to offset their risk with some form of security when borrowing larger amounts to customers. Either way, understanding the purpose of your loan and the precise amount that you need to borrow is crucial to making an informed decision.

Are there Options that Offer a Compromise between Secured and Unsecured Loans?

Now, there may be some instances where your need is a little more convoluted, and this makes it far harder to choose between traditional loan options. Fortunately, the modern financial market has benefited from considerable innovation, particularly in relation to the range of products now available. Many of these now offer a compromise between secured and unsecured loans, primarily by offering cheaper terms and greater flexibility in terms of the assets that can be used as security.

Take car title loans, for example, which are emerging as increasingly popular in 2016 and embody a new generation of lending. In simple terms, a car title loan enables you to access a fixed amount of money by using your vehicle as collateral, as you transfer the title to the lender. Once you repay the loan according to the agreed terms, the title is returned and you and hopefully your financial needs have been satisfied.

Both a short-term and a secured loan, car title loans are far less costly than payday alternatives and in many instances enable you to borrow a little bit more. This does not mean that they are necessarily suitable for your exact circumstances, but they at least offer choice, diversity and some much needed compromise in the marketplace.

Your Income and Earning Potential

While it seems obvious to assert that individuals should not borrow a sum of money that they cannot afford to repay, too many borrowers fail to understand the precise terms of their loan and the demands that will be placed on them. Make no mistake; whether you apply for a secured or an unsecured loan, it is imperative that you fully comprehend what is being asked of you and the consequences of non-compliance.

Such a thought process can also be used to influence your choice as a borrower, as it encourages you to consider your current income level and earning potential. Ultimately, those who have temporary work or a variable income stream should only ever consider short-term, unsecured loans, as this optimises their chance of repaying the total amount while minimising risk.

Conversely, those with a fixed income stream and a viable asset (or more) can consider the more favourable repayment terms associated with secured loans. Of course this increases your risk in the event that you encounter financial problems, but much of this is negated by your ability to comfortably afford the required repayments.

![An Explanation of Small Business Loans [Infographic]](https://lerablog.org/wp-content/plugins/wp-thumbie/timthumb.php?src=http://lerablog.org/wp-content/uploads/2017/05/grthrhe-300x200.jpg&w=300&h=140&zc=1)