If you are in need of quick money for a small business then a merchant cash advance can become a perfect shortcut to funding. Below we collected the basic information about merchant cash advance opportunity and also focus on the benefits it offers.

How Does It Work?

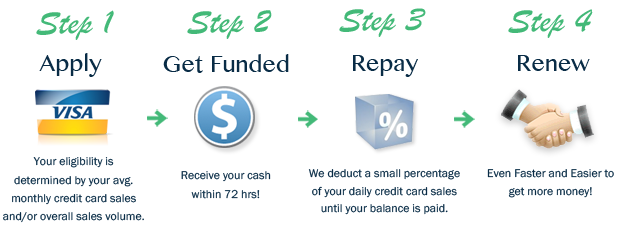

First and foremost thing to remember about a merchant advance is that it is not a loan; it is an advance payment that is made against your business’s future income. It means that a provider of merchant advance gives you a lump sum, which is later repaid automatically with the percentage of your daily credit card.

This percentage is called the “holdback” or retrieval rate. You can get it from 5% to 20% depending on the size of your advance, your business’s sales and, of course, on the repayment period. The term you get advance for varies from 90 days to 18 months. Once you receive the required funds your repayment process begins.

Benefits of a Merchant Advance

Straightforward Application Process

The great thing about merchant advance is that you can easily apply for it online by submitting the application and uploading the required documents.

Funding Is Quick

The greatest benefit of this funding option is that you get money almost instantly because the approval process goes much faster than with loans. According to the statistics, you can basically get approved within several hours and get the required money within a matter of days.

No Need for a Perfect Credit

When you want to apply for a loan you need to demonstrate perfect credit score and history of both your business’s account and your personal account, which is frequently a problem. In case of merchant cash advance lenders you get a different situation. Most of them are more lenient where credit is concerned. As a rule, you are judged by the consistence of your credit card sales and the time you have been in business.

You Need No Collateral

For most kinds of loans you will need to provide collateral to the lender in order to secure your loan. In the case of merchant cash advance there is no need of doing so which means that you will not have to put any of your personal or business assets on the line in order to obtain one.

Flexible Payments

As you might have heard, most small business loans have a fixed interest rate which results into a fixed payment. It means that you owe the lender the same amount every month. For some businesses this scheme may be perfect, but for those who rely on clients in might be not. In case of a merchant advance you get more flexibility as all the payments are based on a flat percentage of your credit card sales. As a result, all of your payments are proportionate to what your business brings in.

Hi,

Your post is appreciatable. It is helpful for beginner/ startup businesses.