CMC markets were launched in 1989 and are one of the leading Contracts for Difference (CFD) and spread betting in the world today. According to a recent research by CANSTAR on online share trading platforms, CMC markets are at the top. They have been at the top for the past 4 years now. The CMC markets are located in more than 22 countries worldwide, with most of them being in Europe and North America. CMC markets trading platforms are one of a kind, built with speed of execution and reliability.

CMC markets were launched in 1989 and are one of the leading Contracts for Difference (CFD) and spread betting in the world today. According to a recent research by CANSTAR on online share trading platforms, CMC markets are at the top. They have been at the top for the past 4 years now. The CMC markets are located in more than 22 countries worldwide, with most of them being in Europe and North America. CMC markets trading platforms are one of a kind, built with speed of execution and reliability.

Range of Markets

CMC markets have a wide range of markets; shares, forex, indices, treasuries, commodities and typical spreads. A person can trade in over 10000 CFD and 9500 spread betting products covering indices, shares, commodities, currencies and treasuries. It has low margins and tight spreads from 0.7 points on EUR/USD and one point on the UK 100 and Germany 30.

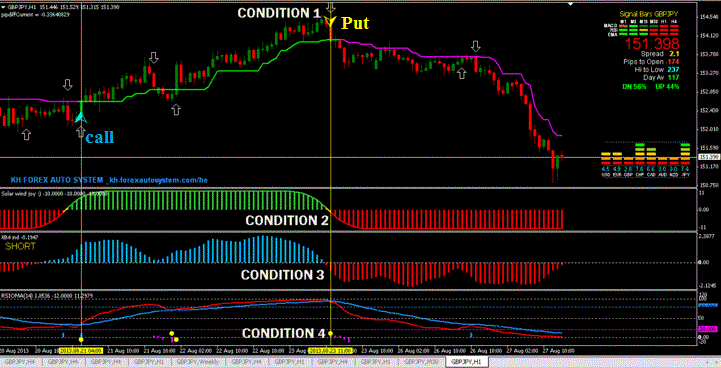

Forex

CMC offers a huge range with over 330 forex products, which cover major, minor, emerging and exotic currency pairs. The minimum spreads range from 0.7 points for AUD/USD to as high as 85 points for USD/ZAR. The spreads are for the first price available for the average market trade/bet sizes in the relevant product. The spreads can widen for larger trade/bet sizes. Usually at the end of each trading day, the position held in a particular account may be subject to a holding cost. The holding cost can be positive or negative, depending on the direction of a person's position and applicable holding rate. Past holding rates are usually expressed as annual percentage rates and a person can view them at CMC's platform within the overview section of each products.

Shares

CMC allows an individual to buy and sell shares in over 9000 global shares, including 1000EFTs. The stock markets that one can buy and sell in include popular stocks like Apple, Bp, Lloyds Banking Group, Tesco, and Rio Tinto among many other stock markets. Trading hours differ depending on the country and are on a daily basis. A person has to pay a commission charge when trading CFD shares on the CMC markets platform. The commissions are charged upon execution of any order and minimum commission (minimum commission payable to trade a share CFD and is associated with trading a share) charges may apply.

Commodities

Various commodities ranging from minerals such as gold silver and copper and cash crops such as corn, coffee and cotton can be sold through the CMC markets. The margin rates differ depending on the commodity being sold and can be as low as 0.75% in the case of crude oil west Texas and as high as 3% for wheat and rough rice.

Typical spreads

Typical spreads indicate the consistency of prices throughout the trading day. In CMC markets the typical spreads are usually closer to the minimum spreads. The latest typical spreads, which were recorded for the month of December 2015, were as high as 2.1 points and as low as 0.9 points depending on the products. Typical spreads are the most common spreads per instrument across all trading periods.

With the above information, you can get a better understanding of CMC markets.