There are so many things that we can say in order to help you make sure that 2015 will be a great year for your company. The problem is that we are faced with so many different things that can be done that it will be difficult to talk about everything. Make sure that you take into account the help of professionals whenever you believe that you are not currently awareof all that you need in order to be successful. You can look at Today's Growth Consultant click here. This would offer an idea of how a growth consultant can help you.

There are so many things that we can say in order to help you make sure that 2015 will be a great year for your company. The problem is that we are faced with so many different things that can be done that it will be difficult to talk about everything. Make sure that you take into account the help of professionals whenever you believe that you are not currently awareof all that you need in order to be successful. You can look at Today's Growth Consultant click here. This would offer an idea of how a growth consultant can help you.

Out of the various things that you have to consider, managing cash flow is, most likely, critical. That is especially true in the event that the organization wants to protect liquidity and grow in the future. The owners understand that they have different cash sources that are available but they rarely have a plan to actually manage everything that is obtained.

The Importance Of Cash Flow

Believe it or not, cash flow stands out as a company's lifeline. It is also an important accountability and management tool. You should always arrange some sort of cash flow projection since very single person working in the company will appreciate this more.

At an internal level, regularly maintained cash flow projection can help to develop attainable and timely goals. When the owners and the management team know all the amounts that come in and go out, plans can be adopted in order to properly manage this cash flow. When external sources bring in cash, projection shows the stakeholders that everything is working properly and that the investment was well made. At the same time, banks may require a quarterly financial information report.

What Is Included In Cash Flow Projections?

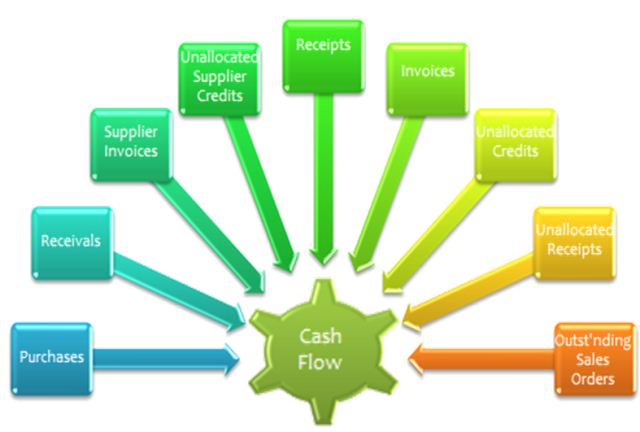

The business leader has to include data that comes from many different sources. As an example, the owner has to analyze the accounts receivable in order to determine how to turn them into cash as soon as possible or how to better manage sales in order to improve profitability. Even inventory is analyzed because excess inventory can easily be translated into cash. To put it as simple as possible, every single asset or dollar is included in a cash flow projection plan.

Remember the fact that when you do not know how to properly manage the funds of your company, you can end up faced with the unwanted situation in which you completely lose control. That would destroy your current business growth potential and you can even end up in the unwanted situation in which you would make huge mistakes and you would end up in bankruptcy. That is how important cash flow management is.