2015 is a new year and there are a few new tax forms to go along with it, as well as a new line on Form 1040, thanks to the Affordable Care Act.

2015 is a new year and there are a few new tax forms to go along with it, as well as a new line on Form 1040, thanks to the Affordable Care Act.

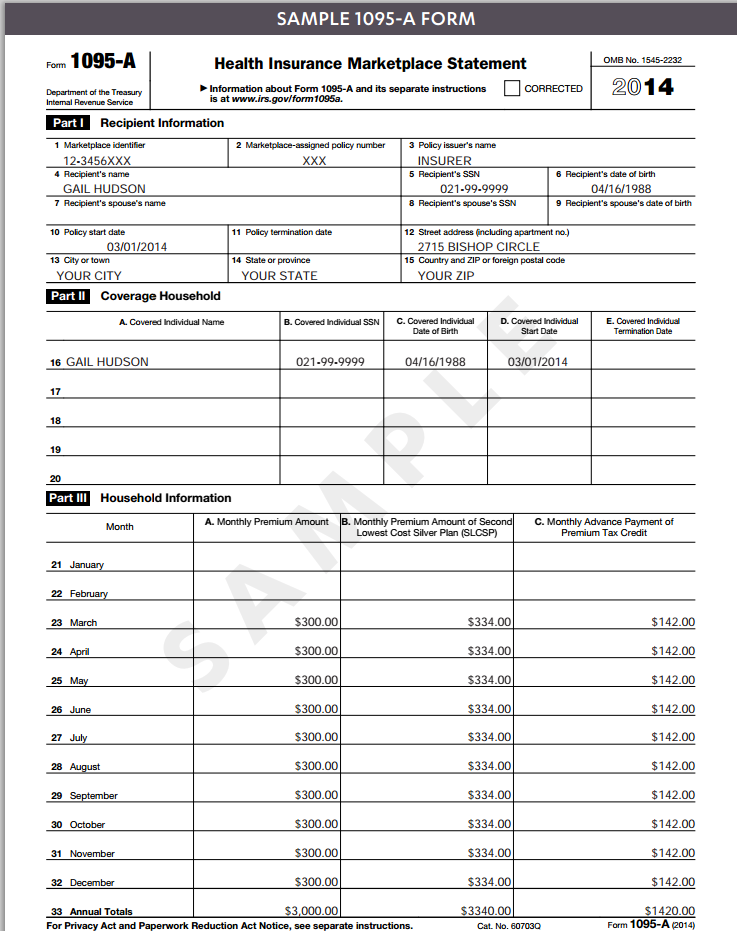

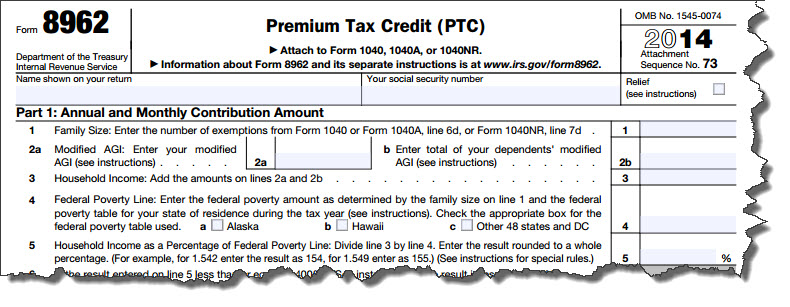

Form 1095-A, the Health Insurance Marketplace Statement, and Form 8962, the Premium Tax Credit (PTC) form, are required for anyone who enrolled in insurance through the Health Insurance Marketplace in 2014. Form 8965, Health Coverage Exemptions, is required to claim or report eligible coverage exemptions. Form 1040 line 61 asks if everyone on the return has qualifying health care coverage for the entire year.

Of the almost 8 million people who purchased health-care policies through the insurance exchanges in 2014, about 85 percent received subsidies. The IRS estimates that as many as six million 1095-A will be issued this tax season.

Taxpayers who received new marketplace health insurance last year must use new tax forms this year to file their tax returns. They can expect to receive 1095-As from the marketplace they bought their insurance from, not employers or the IRS. If they don't receive a 1095-A, or if they feel there are error on the information on the form they receive, they should go back to the marketplace for resolution.

They'll use the information on Form 1095-A to calculate the amount of premium tax credit claimed on their tax returns with Premium Tax Credit (PTC) Form 8962. Form 8962 specifically requests information from Form 1095-A for completion for tax filings. They'll check the box on line 61 of their tax return if everyone on the return had qualifying health care coverage in 2014. Otherwise they'll need to file an exemption if eligible, or make an individual shared responsibility payment.

Employers and the ACA in 2015

Employers won't see as big a change in tax filing requirements this year because ACA penalties for employers were graduated. Employers with 50 to 99 employees have until 2016 to comply with ACA rules and larger employers with 100 or more employees have some ACA compliance requirements.

ACA rules require businesses with the equivalent of 50 or more full-time employees to offer coverage qualified coverage or pay a fine. Qualified coverage under ACA definitions costs employees no more than 9.5 percent of their W-2 income and must pay at least 60 percent of costs.

Employers who have to offer insurance have additional reporting requirements under ACA. If they don't offer insurance as required, they may face fines of up to $2,000 per employee.

If you have questions about tax forms, call Pogosian CPA, former IRS tax auditor. We can help you understand ACA requirements, forms, and penalties.