America is the greatest country in the world, because hard work yields incredible results. Yet in still one can put forth a lifetime of hard work and lose it all because of someone else. Uninsured motorists are a threat to anyone who takes to the road. Most law abiding drivers wrongfully assume their insurance automatically compensates for uninsured motorists, but this is a common misconception.

States That Require Uninsured Motorist Coverage

- Washington D.C.

- Illinois

- Kansas

- Maine

- Maryland

- Massachusetts

- Minnesota

- Missouri

- New Hampshire

- New Jersey

- New York

- North Dakota

- Oregon

- Rhode Island

- South Dakota

- Vermont

- Washington State

- Wisconsin

The Real Threat of Uninsured Motorists

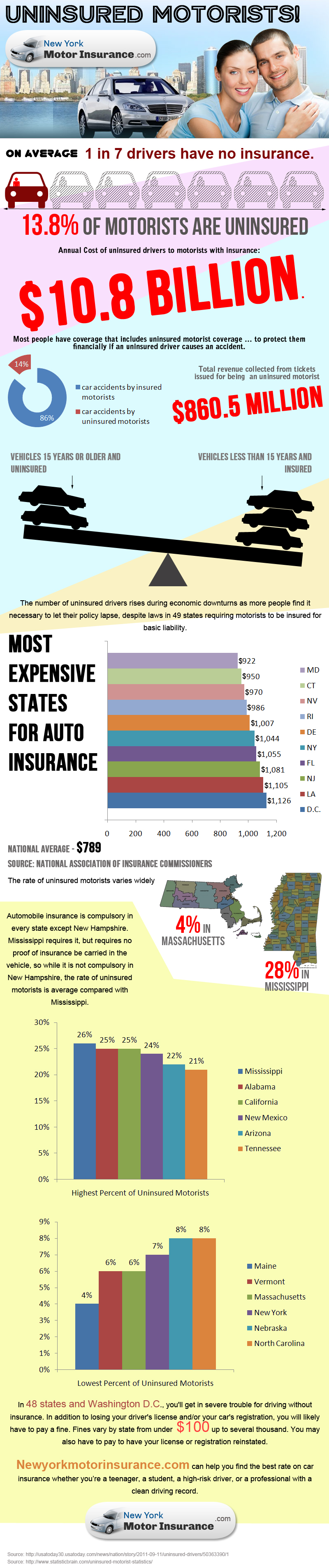

When you take to the road, you don’t really think about the other drivers. You respect their vehicles, but the individuals actually piloting those cars rarely cross your mind. However, roughly 13% of your fellow motorists are currently uninsured. That’s about one in every eight which is cause for serious concern.

A fender bender with an uninsured motorist is little more than a nuisance. The other driver may be sited for driving without insurance if you even bother to call the police. Unless you go to small claims court, you’re probably going to get stuck with the bill. However, a serious collision can lead to more than just body damage.

The 13 Figure Issue

Annually, auto accidents in America cause more than $1 trillion in property damage, medical expenses, loss of productivity and funeral expenses. This is an alarming number when one considers that 1/8 of drivers are uninsured. That means roughly $125 billion in damage is annually caused by uninsured motorists. A policy for uninsured motorists is offered in additional to supplement the legal limit. In most states, uninsured motorist coverage isn’t a requirement, so the rest of us foot that enormous bill.

The loss of productivity is hard to calculate, but there are separate policies that accommodate for lost work time. However, the medical expenses from an accident can be crushing. Even if all the injured passengers have medical insurance, the rising premiums and deductibles can be expensive. This is at a time when the family’s income is probably reduced as well. Even if no one is injured in the accident, it can still be financially devastating. Having just one of your vehicle’s major systems (Engine, Transmission, Suspension) damaged is going to cost thousands to repair. Public transportation may not be a solution to your transport needs, and you could be faced with a catch 22. You can’t get the vehicle fixed because you can’t get to work to earn money. You can’t make get to work to make money, because you can’t get your vehicle fixed. Uninsured motorists are a threat to everyone else on the road, and they’re more notorious in some states than in others.

When it comes to the worst states for uninsured motorists, there are some surprises on the list. One might expect rural areas like Alabama (7th at 19.6%) and Oklahoma (1st at 25.9%) to have higher uninsured motorist rates. There’s a lot more space out there and a collision is a lot less likely. However, Rhode Island has the 8th highest rate at 17% and Michigan is 5th at 21%. Florida (2nd at 23.8%) is also a surprise, because it’s such a densely populated area. Yet in still almost 1/4 of every driver in The Sunshine State is uninsured. Overall, California and Texas have the most uninsured motorists, but this is to be expected.

Why do I Have to Pay if I’m Insured

What you purchase from the Insurance company is liability insurance. This means they agree to pay for any damages if you’re liable. When someone else is at fault, the liability insurance isn’t going to pay for any hospital bills or property damage. Even in states that require uninsured motorist coverage, it’s sold as a separate policy and bundled with the liability insurance. In fact, liability insurance is the only constant among the fifty states, so do some research to find out just how much coverage you have.

Avoiding an Accident

Even if the other driver is insured, a vehicle collision can still be devastating. The only good accident is the one you can avoid with defensive driving techniques. These techniques consist of pre-determining potential threats and taking steps to avoid them. Fortunately, there are a number of defensive driving and traffic school courses that can help you to avoid an unfortunate collision.