The Bill is almost the most important document of our turnover. It is the key point of our economic activity, to justify expenditures and revenues you’ve had during the quarter and at year end. You must take into account that it is also called as “lifetime tickets” amendment Bill. But it is not an invoice, for the simple reason that does not carry the fiscal information of the transmitter and receiver.

The Bill is almost the most important document of our turnover. It is the key point of our economic activity, to justify expenditures and revenues you’ve had during the quarter and at year end. You must take into account that it is also called as “lifetime tickets” amendment Bill. But it is not an invoice, for the simple reason that does not carry the fiscal information of the transmitter and receiver.

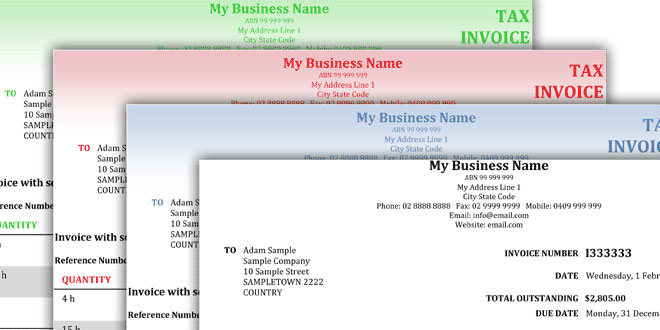

HOW TO MAKE A FREE INVOICE?

It is very important to know how to make free invoice. You have many options to make an invoice. The simplest is to set up a receipt template with different fillable fields that allow you to go writing and changing the information depending on the customer. Previously, it was done by hand and with paper, but today there are different ways.

But with the application of new technologies, it is easier to make them and send them. There are some that have a lot of designs. The logo and structure are customizable while showing all the data you want. Another easy and comfortable solution are applications of invoices, as Quipu. Where templates are already made and you only have to fill in the default fields. This allows you to create invoices quickly and easily without forgetting any required field.

WHAT SHOULD CONTAIN AN INVOICE?

All invoices must always contain the following fields:

1. Numbering:

With numbering; it becomes easy to keep the things in order. We need to number them without repeating it so that we know every order of it. You can start by 40 or 1, but never repeat them and above all, with correlative numbers. I.e. after 1, 2 and not 4. One behind the other: 40, 41, 42,…

2. Date of issuance:

The day that created it. If, for example, we do an invoice corresponding to the month of June: the issue date will be 30 June 2014.

3. Expiration date:

In other words, “the day that Bill expires”. To date we have to proceed to the payment or collection.

4. Tax information:

Both yours and that of your client as this is the essential difference between a Bill and a ticket. The presence of information on both sides.

– Your name or that of your company.

– The number of tax identification for the company or the ID in case of being autonomous.

– Domicile.

5. Concept and types tax applied:

The reason for the operation, description, service. For example, services of consultancy, sale of commercial material, etc.. with all the important parts of the price:

– Taxable income: Amount Excl. VAT.

– The VAT rate applied: 4, 10, or 21%.

– Discounts if any, should also be reflected.

– As well as the retention of income tax, applying retention.

6. For companies:

Commercial register. You must show the log information. The folio, page, volume etc.